Despite historic market declines, Q1 ETF investment remains positive

Considered a win for long-term Canadian investors, ETF providers are challenging the marketplace to continue to compress fees across the board. istock.com

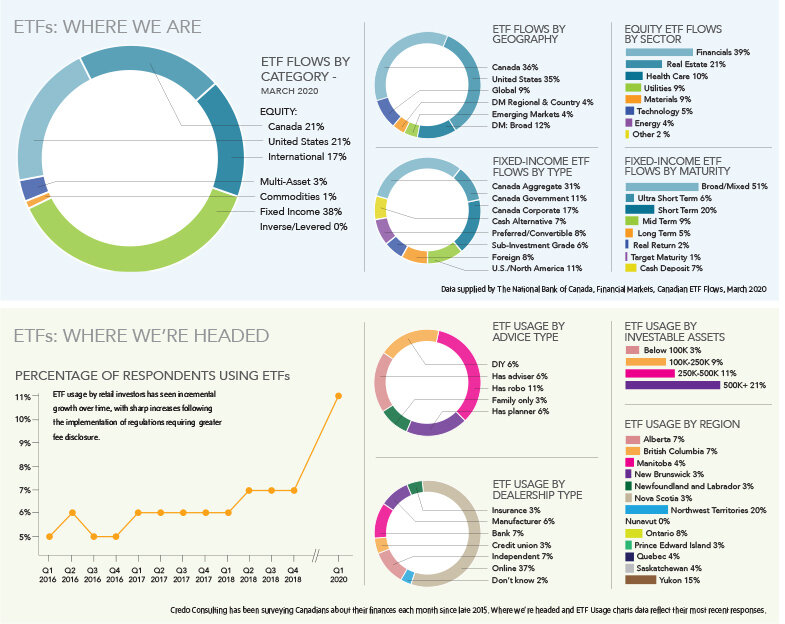

April arrived along with a ferocious bear market, but surprisingly, Canadian exchange-traded funds (ETFs) saw more investment in than out in March. It was a continuation of a longer-term trend, favouring ETF investments even in the face of extreme market forces.

High-interest savings account ETFs attracted almost $4-billion last year, and one factor at play was “bottom feeding,” investors shifting cash into equity markets hitting valuations they consider more reasonable.

But the data trends show that this is also an intensification of other changes that have been underway for some time. While ETFs are now 30 years old in Canada, the past five years have seen an overall shift in the way they’re used, says Steve Hawkins, president and CEO of Horizon ETFs, and chair of the board of the Canadian ETF Association (CETFA). “I think investors were waiting for this correction to happen.

“ETFs have empowered investors and advisers to be able to make asset allocation decisions swiftly and efficiently; to trade in and out of markets as they want, depending on their views. Five years ago, ETF investment was largely institutional; today, ETFs are the investment vehicle of choice for retail investors as well.”

Another primary driver of ETF popularity is increasing fee awareness among investors and advisers, explains Mr. Hawkins. “With the implementation of CRM2 (a regulatory framework for investment fee disclosure), fees have become much more important for clients in understanding their ultimate returns. The majority of investment advisers are now fee-based; five years ago, the majority were commission-based.”

The introduction of a vast array of new products has made it possible to access any investment strategy in an ETF wrapper, he adds.

“Five years ago, ETF investment was largely institutional; today, ETFs are the investment vehicle of choice for retail investors as well. ”

ETFs outsold traditional mutual funds in 2018 and 2019; in the first three months of 2020, the pace intensified. “We’re not seeing this new investment in the capital markets being put into mutual funds. It’s being put into ETFs. The same is true in Australia, the U.S. and the U.K. – it’s global.”

ETF providers are challenging the marketplace to continue to compress fees across the board, which is a win for Canadian investors over the longer term. For now, says Mr. Hawkins, “ETFs are better tools for investment advisers to create portfolios for clients focused on ultimate returns.”

The trends at play today have their roots in the 2008 global financial crisis, says Tyler Mordy, president and CIO of Forstrong Global and a CETFA board member.

“The game-changing benefit of this financial innovation is that, by the time we emerged from the last financial crisis, it became evident that investors could build truly globally diversified portfolios exclusively with ETFs. In the last five years, we’ve seen these trends accelerate.”

Since the emergence of Covid-19, he says, investors have used ETFs to fulfill a variety of strategies, including implementing risk management approaches.

“The ETF structure is resilient and solid; it doesn’t cause systemic risks. For example, the bond market has become very illiquid, but bond ETFs have continued to trade and provide a crucial source of liquidity.”

Each time a market crisis arises, ETFs attract criticism, he says, and “come under fire for causing ‘systemic risks.’ It’s viral misinformation, and I’m always shocked at the widespread level of misunderstanding in the investment community. Many investors mistakenly believe ETFs are ‘forced sellers,’ a complete lack of understanding of ETF mechanics. ETFs are designed to follow trends, not make them, which is why they are called ‘trackers’ in Europe. And most ETF trading takes place on secondary exchanges, without impacting the liquidity of the underlying securities.”

ETFs are also proving more “sticky” than mutual funds in terms of asset flows partly because of their portfolio-building convenience, says Mr. Mordy. “It’s far easier to stay the course when you’re in a balanced, diversified portfolio.”

For more stories from similar features, visit globeandmail.com