Specialty brews boost coffee sales in Canada

Coffee, Canada’s go-to drink, has become a multi-billion-dollar industry spurred on by increasingly adventurous consumers looking for new taste challenges

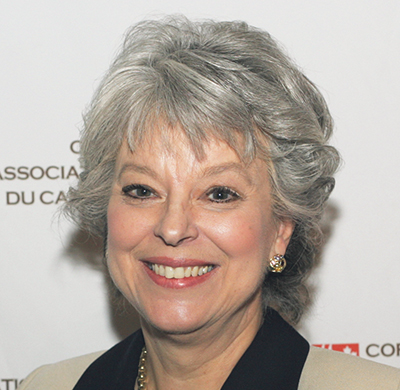

Innovation is driving the growth of Canada’s $6.2-billion coffee industry with specialty coffees, new preparation methods and technology helping lift sales to new heights, according to Lesya Balych-Cooper, president of the Coffee Association of Canada (CAC).

The most popular beverage among adult Canadians, who drink an average 3.2 cups of coffee a day, the sector is a favourite with that most desirable demographic, the millennials.

Ms. Balych-Cooper says the 2016 CAC Coffee Trends survey shows the number of 18- to 24-year-olds who said they drank coffee ‘yesterday’ is up from 38 per cent in 2008 to 58 per cent in 2016.

“Today’s consumers are engaged in a conversation about ethics, technology and sustainability. It’s a much more intellectual conversation about a cup of coffee that overlays the drinking of the coffee.”

“That’s 20 points: it’s huge,” she adds.

While traditional or brewed coffee is most likely to be consumed by people between 65 and 79 years old, sales of specialty coffee have grown from 13 per cent in 2013 to 19 per cent in 2016.

“Those six points are a very relevant growth indicator,” says Ms. Balych-Cooper. “It’s attributable mainly to millennials. According to our surveys, we know that more and more [18- to 34-year-olds] drink espresso, iced, frozen and branded coffee drinks than those people who are 35 and older.”

The numbers also show a 3 per cent increase, from 2015 to 2016, of cold speciality coffee compared to hot specialty coffee. Nitro brewing, an innovative preparation method that infuses cold brewed coffee with tasteless, odourless nitrogen gas to produce a smooth beverage with a creamy texture, is a trendsetter in this category.

While Canada recorded the fastest sustained growth of the traditional importing markets for coffee (North America, Europe and Japan) over the past decade, sustaining and boosting the industry requires that companies understand their consumers.

“Many millennials will make choices about where they go in terms of how they can experience their coffee, and even when they choose a traditional way of experiencing coffee, they may want to have a coffee that is grown in a fair trade environment.

“Today’s consumers are engaged in a conversation about ethics, technology and sustainability. It’s a much more intellectual conversation about a cup of coffee that overlays the drinking of the coffee,” says Ms. Balych-Cooper.

Historically the industry has understood the journey from the farm gate to the consumers’ lips.

“That aperture has been widened now. People want to know more than just the farm gate. They want to know what’s happening on the farm. What is it doing to the people that work there?

What is it doing to the environment? They don’t just want to know what it tastes like,” she adds.

Ms. Balych-Cooper says almost a quarter of the people surveyed say that they want to know that the coffee beans are grown on farms that treat their workers well. They also want to know if the companies buying the beans support the communities where the coffee is grown.

“These are all things that might make millennials, or anybody for that matter, choose a particular coffee experience. Some might buy just to support growers in certain countries. It’s a much deeper conversation.”

Meanwhile, innovation is also increasing sales of coffee in grocery stores, says Robert Carter, executive director, foodservice at market research firm NPD Group.

While the CAC Coffee Trends survey showed that seven out of 10 cups of coffee are consumed at home, Mr. Carter says the once ubiquitous drip coffee maker is being challenged by the single-cup pod system coffee machines. He says this trend is fuelling the purchase of pods, a more expensive option than traditional packaged coffee.

Mr. Carter says convenience is the major reason Canadians are embracing the system.

“It’s more convenient to brew a single cup rather than brew a whole pot of coffee. The easier you make a process the more consumers will respond,” he adds. The selection and variety of coffee available in pods is also boosting sales.

“But the millennial cohort is very concerned about their food and beverages, and the pods are not recyclable. The industry will have to deal with this barrier to growth, and I anticipate that in the next 24 months they will have resolved it,” he says.

And while the pods, with their higher price point than traditional packaged coffee, are also good news for grocery stores, they face a challenge from that great disruptor, the Internet.

“The pods are easy to deliver, so buying them online is an attractive and less expensive option,” Mr. Carter points out.

The CAC notes that coffee in the food service industry (any place where coffee outside the home is served) is worth $4.8 billion a year.

Restaurants may have been ahead of the trend in the specialty coffee category with their decades-old menu offerings of post-dinner drinks like Irish Coffee and Café Amaretto. Ian Tostenson, president and CEO of the BC Restaurant and Food Services Association, says fine dining restaurants in particular have the opportunity to benefit from the growing appetite for specialty coffee. “It is a good profit centre for restaurants; it absolutely ups the average check,” he adds.

Ms. Balych-Cooper says a break to enjoy a cup of coffee is one of the simpler pleasures in a busy day. “Whether you want to call it an indulgence or just a rest, it gives that little moment of pleasure. It’s wonderful to have that pause to enjoy it.”

For more related to this story visit globeandmail.com